Chapter 13 Information

We often receive calls from potential clients who want to know how far behind they must be before their mortgage company will start a foreclosure. One month? Two months? Five months?

The answer to this question is “it depends.” Technically, your mortgage company could start foreclosure the day after your “late payment date,” which is usually 10 or 15 days after the on-time due date. As a practical matter, however, most mortgage companies will not start the foreclosure process until you are at least three months past due.

The mortgage foreclosure process is expensive for your mortgage company to pursue and you can be assured that they would much prefer to see you current. As you may know, mortgage loans are bought and sold as commodities, and a “performing” loan carries much more value than one that is delinquent.

Generally, when your payment is not received by the “late payment date,” you will receive a call from a mortgage company customer service representative. This person will remind you that your payment has not been received and ask you when you plan to pay.

As a rule you should not ignore these calls. As noted above, most lenders do not want your loan to go into foreclosure and their customer service people often have the power to work out payment arrangements, especially if your delinquency was caused by something unexpected like a sudden job loss or family emergency.

On the other hand, you should be careful when talking to anyone who works for your lender, and you should assume that your phone call is being recorded. Never make promises to pay that you cannot fulfil. If the customer service representative should become rude and intimidating, do not be afraid to ask to speak to a supervisor or to request another agent.

Under no circumstances should you ever authorize your mortgage company to deduct money directly from your checking or bank account. If this issue ever comes up, you should tell the rep that you need to speak with your lawyer, hang up and call our office immediately.

Do not forget that customer service representatives working for mortgage lenders are collection agents who have been trained in the psychology of collection. They will be following a script that has been written to intentionally keep you off balance and to undermine your self confidence. You must keep in mind that your mortgage delinquency is a business problem and not a moral failing. If the customer service representative starts talking about guilt – such has how your family would react if you lost your house to foreclosure, red flags should go up in your mind that the collection agent is trying to manipulate you.

If you ever find yourself becoming uncomfortable with conversations you are having with a mortgage company customer service representative, you should feel free to call Clark & Washington at 770-488-9300 and speak with someone who has your interests in mind and who can advise you about how to handle mortgage company collection agents.

The main thing that you need to know about the foreclosure process in Florida is that it can happen very fast – in as little as 37 days start to finish. Unlike other states, Florida does not require mortgage companies to go to court to foreclosure on homes.

The main thing that you need to know about the foreclosure process in Florida is that it can happen very fast – in as little as 37 days start to finish. Unlike other states, Florida does not require mortgage companies to go to court to foreclosure on homes.

Instead, the mortgage company need only give you written notice of the foreclosure, then advertise notice of the foreclosure for four weeks preceding the foreclosure. Foreclosure notices must be published in the legal newspaper of the county where the property is located.

Once these notice requirements are met, your lender can sell your house on the courthouse steps and you will no longer own your house.

It may seem strange to you that your mortgage company can take possession of your home without having to go before a judge to do so, but that is how Florida law is written. When you signed your mortgage loan papers you gave your lender the authority to foreclosure using this expedited notice procedure.

Florida Foreclosures Only Occur on First Tuesday of the Month

You also need to know that foreclosure sales in Florida can only take place on the first Tuesday of a month. Law firms like Clark & Washington prepare and file dozens of Chapter 13 cases during the week prior to “foreclosure Tuesday.” While we can handle last minute stop foreclosure cases, you are better off contacting us as far in advance as you can.

If you have a first and second mortgage, you should realize that either the first or the second lender can start foreclosure proceedings. In fact, second mortgage holders are often more aggressive than first mortgage lenders because in today’s market, many houses are worth less than the total of what is owed, and second mortgage lenders only get paid after the first mortgage is satisfied..

Unlike some of our competitors, Clark & Washington never charges a fee for a helpful telephone or office visit. Therefore, if you think that you may be in foreclosure but you are not sure, or even if you just need some planning advice, we invite you to call us.

Additional reading:

Click on the link to learn more about how you can determine whether your house is currently in foreclosure.

Florida law allows mortgage companies to foreclosure on your home without a requirement for a hearing before a judge. Most mortgages written in Florida contain a limited power of attorney whereby you authorize your mortgage company to foreclose simply by sending you written notice of default and by advertising in the legal newspaper for the county where the property is located.

Unlike some states, where the foreclosure process can take several months, your home can be sold at a foreclosure sale in as little as 37 days.

In reality, very few foreclosures happen this quickly. Most mortgage companies will send you letters and call you once you miss one or two payments. Usually foreclosure does not start until you are at least 3 months behind. Once foreclosure starts, however, it can be very difficult to stop and once the process starts, you cannot delay your reaction to this process.

The law says that the mortgage company must write you – at the mailing address they have on file for you – to advise you that the foreclosure process is starting. If you have moved or if you have had trouble getting your mail, you should not hesitate to contact the lender’s lawyer by phone and in writing to inquire as to whether your property is in foreclosure. Some foreclosure law firms post pending foreclosure information online. You can usually get the name of the foreclosure lawyer by calling your mortgage company.

If you receive a notice of foreclosure, do not ignore it because time is running out. Call our office to speak with a lawyer about your bankruptcy and non-bankruptcy options.

The law also requires foreclosing lenders to publish foreclosure notices in the legal newspaper (also known as the legal organ for your county) for the county where your property is located. Most “official legal organs” can be found by entering “official legal organ for XYZ county, Florida” in Google or Yahoo. These notices are entitled “Notice of Sale Under Power” and contain a notice of the foreclosure and a legal description of the property being foreclosed. The foreclosure notice will also indicate the date of the sale and the name of both the lender and the lender’s foreclosure attorney.

It is possible that your official county newspaper may contain dozens or even hundreds of foreclosure notices and it may be difficult to find your notice. If you think that your house may be in foreclosure, you should be proactive in finding out – call your lender, or call the lender’s attorney if you know who that is. You can also call our office and we can help you find out if there is a pending foreclosure.

In larger counties especially, foreclosure notices are read by real estate investors, bankruptcy lawyers and “workout” companies who use lists of pending foreclosures to market their services. This is perfectly legal and there are a number of companies that gather foreclosure information and sell lists. If you are living in the at risk property, you will likely start seeing dozens of letters and flyers in your mailbox all offering to “help” you deal with your foreclosure.

Again, we at Clark & Washington stand ready to offer legal advice to you about Chapter 13 and Chapter 7 bankruptcy and about possible non-bankruptcy options.

Like you, the attorneys and staff of Clark & Washington hear those radio and tv ads from “foreclosure relief” or “foreclosure prevention” companies. These businesses claim to have the information that “the mortgage companies don’t want you to know” and promise that they can stop foreclosures even after advertising has started.

Clark & Washington’s senior attorneys advise you to be very careful when dealing with a “foreclosure relief” company. While some of these businesses may be legitimate, there are many that operate on the fringes of the law.

If you are thinking about engaging the services of a foreclosure prevention company, here are a few suggestions:

- check out the company with the better business bureau or the Governor’s Office of Consumer Affairs. Multiple complaints should be a warning sign

- research the company on Google or Yahoo. Do they have a web site? Have others posted opinions or reviews about their work?

- does the company have a physical address – we advise you to steer clear of businesses that operate out of a post office box or who fail to list a physical address with a real phone number

- what provisions does the company have if the proposed modification or deal to stop foreclosure does not go through. Is there a “drop dead” date whereby the company will advise you to seek Chapter 13 protection to stop the foreclosure

We know from our dealings with mortgage company default offices, that once a home goes into foreclosure the lender becomes more and more reluctant to stop the foreclosure process. This is especially true if you do not have a lot of money to bring to the table. Don’t let promises and fast talk stop you from at least investigating the bankruptcy option.

Chapter 13 bankruptcy functions as a three to five year payment plan that is supervised and approved by a bankruptcy judge and and a bankruptcy trustee. Unlike voluntary payment arrangements, bankruptcy court approved Chapter 13 plans bind all creditors – they have to accept the terms and the payouts set out in the plan.

Your Clark & Washington lawyers have years of experience preparing Chapter 13 plans that will meet court approval but also leave you with enough money to pay your bills and live your life as you see fit.

In order to qualify for Chapter 13 you must have a regular source of income that can be used to fund your plan. Acceptable sources of income include:

- wages from a job

- earnings from self employment

- payments from Social Security

- payments from a workers’ compensation insurance company

- payments from a pension or retirement plan

- child support or alimony

- regular support from family or friends

You must also have enough “disposable income” left over at the end of the month to pay into your Chapter 13 plan. You might be surprised to learn exactly how much disposable income you actually have after your Clark & Washington lawyer works with you to prepare a budget and proposed repayment plan.

You must be a living person to qualify for Chapter 13. Corporations and estates of deceased persons do not qualify.

There are a few other requirements that affect people who have previously filed Chapter 7 or Chapter 13 (ask your lawyer) but as you can see, the requirements to qualify for Chapter 13 are fairly reasonable.

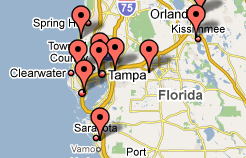

If you think that Chapter 13 may be appropriate for you, please call our office for a free, friendly consultation. Our telephone number is (813) 345-5954.

Clark & Washington gathers a great deal of information to properly prepare your Chapter 13 case. We will need information about your debts and assets, your budget, and other financial information. Please gather as much of the following information as you can to help us serve you better:

- copies of your bills – we will need the name, mailing address and account numbers for all of your creditors, including credit cards, installment notes (on cars, furniture, etc.), finance companies, personal loans

- copies of letters you may have received from your mortgage company or its foreclosure lawyers

- a simple budget – what are your household earnings and household expenditures

- copies of pay stubs – ideally we need copies of pay stubs for you and your spouse (even if spouse is not filing) from past 7 months

- copy of last year’s federal tax return

- credit counseling certificate – you can get this at our office if you do not already have

As you have probably learned, Chapter 13 functions as a payment plan. Unlike informal payment plans or repayment schedules created by debt reduction companies or even Consumer Credit Counseling, Chapter 13 plans arise from binding orders issued by federal bankruptcy judges. Once a plan is “confirmed” all creditors are bound by its terms whether they agree with the Chapter 13 plan or not.

Chapter 13 takes its name from the federal bankruptcy Code. The part of the Code that sets out the rules for an individual debt reorganization happens to be categorized under Chapter 13 of the Code – thus the name. Click on the link to take a look at the federal bankruptcy Code – you will note that Chapter 13 is called “Adjustment of Debts of an Individual with Regular Income.”

The Bankruptcy Code provides that a Chapter 13 plan must last at least 3 years, but no more than 5 years. The 2005 changes to the Bankruptcy Code make 5 year plans the norm for Chapter 13. So, when you file your Chapter 13, you should assume that you will be subject to the terms of your Chapter 13 plan for five years.

If you fulfill your plan obligations and pay creditors as set forth in your plan, you will, in most cases, be eligible for a “discharge.” A bankruptcy discharge is a special court order that forever protects you from claims of your creditors. For example, if your court approved plan provided that unsecured creditors like credit card lenders only get 5 cents on the dollar, and you make payments as scheduled for five years and receive a discharge, your credit card lenders cannot come back and demand the 95% of debt that was discharged in your Chapter 13.

Clark & Washington works very hard to draft a Chapter 13 plan that you can live with because we want your plans to succeed. Five years is a long time and a plan that does not provide enough money for living expenses will likely fail. You can rely on our experience to guide you when it comes to creating a payment plan that satisfies the requirements of the Bankruptcy Code but also leaves you enough money for food, clothing and other essentials in your budget.

Yes, you can sell your house even if you are in the middle of your Chapter 13 case. However, you must obtain permission from the judge if you want to sell your house because a sale will change your financial picture, and thus impact your plan. Here at Clark & Washington we regularly prepare and file motions to sell property. We will need to include in our motion and associated paperwork:

- information about proceeds received – will you be walking out of closing with a check?

- if you will receive sale proceeds, what do you intend to do with the money?

- information about your new budget – presumably you will have new living expenses at a new place to live

Sometimes we will have to strike a deal with the trustee to pay some of the sale proceeds into your plan. Sometimes we will not have to do this.

If you have arranged to buy a new house and will use the sale proceeds for a down payment or moving expenses, we will have to file another motion to obtain permission from the judge to do this.

Motions to Sell Property and Motions to Incur New Mortgage Debt are not complicated motions but as you can see, when you are in bankruptcy this process can become more complicated. Clark & Washington clients can rest easy knowing that their experienced Chapter 13 attorneys have handled numerous Motions to Sell and Motions to Incur New Debt.

Obviously if you want to sell property and you are in bankruptcy, you should contact your lawyer even before you talk to a real estate agent. The real estate agent will need to be authorized to act as a professional agent by the bankruptcy judge as well.

As Chapter 13 functions as a payment plan, the general answer to the question “do my creditors get paid when I file Chapter 13?” is “yes.” However, not every creditor gets paid in full and some creditors are paid before others.

In a Chapter 13, creditors within the same “class” get paid at the same rate. Creditors in Chapter 13 can be:

- priority creditors – like recent tax debt, child support and certain salary claims by employees

- secured creditors – like mortgage lenders, car lenders, furniture and jewelry lenders, and judgment creditors – creditors whose claims are secured by property

- unsecured creditors – like credit card lenders, medical providers, signature loans

In addition, some unsecured creditors get special treatment – such as credit card debt where there is a co-signer, or student loan debt.

Priority creditors almost always get paid in full, secured creditors usually get paid in full or at least to the extent of the value of the collateral securing the loan and unsecured creditors get paid anywhere from 1 penny on the dollar to 100 cents on the dollar depending on a variety of factors.

Generally secured creditors get paid first, followed by unsecured creditors and priority creditors. However, every case is different and your attorney will guide you as to the appropriate payment schedules for your case.

The Chapter 13 plan that your Clark & Washington lawyer will draft and submit to your trustee and judge will provide for specific payments to your creditors. We will set out actual dollar amounts that many of your creditors will be paid.

The calculations that go into developing a confirmable Chapter 13 plan can be complicated and require the input of an experienced Chapter 13 lawyer who understands both the Bankruptcy Code requirements as well as the Local Rules that apply in the Northern District of Florida. You can feel confident with Clark & Washington by your side.

While every Chapter 13 case filed by Clark & Washington has the potential to work, not every case will be confirmed. By far the biggest problem that we see in Chapter 13 has to do with funding – if a debtor does not make his payments to the trustee, his case will not be approved.

If you are paid every two weeks, a deduction will be taken from every check. If you are paid weekly, the you will see the deduction every week.

If you are self employed, then you will have the responsibility to send in a payment at least once a month.

Often, it can take 1 to 3 pay cycles before a payroll deduction “kicks in.” During that time you must send in the trustee payment yourself. A problem that often arises – an employer does not start the payroll deduction until 30 to 40 days into the case, leaving the debtor a month or more behind. If you can eliminate funding problems from your case, your chances of success go way up.

What if I Lose my Job During my CaseAn unexpected job loss can also result in the failure of a Chapter 13 case. Generally, an interruption in plan payments is a bigger problem the earlier in the process it happens. For example, if you filed your Chapter 13 case three weeks ago, and your case has not yet been confirmed (formally approved) then a loss of income and plan funding source will likely result in a dismissal or a conversion to Chapter 7.

By contrast, if your case was confirmed two years ago and you lose your job unexpectedly, we can usually work out a deal with the trustee to give you a two to three month suspension in play payment obligation so that you will have the time to keep your case active while you search for a new job.

Because Clark & Washington has represented literally thousands of debtors over the past 20+ years, our attorneys have seen just about every possible problem that could arise in a Chapter 13 case. Just about every Chapter 13 problem has a solution and we pledge to offer you the benefit of our experience and expertise to make your case succeed.

No, your spouse does not have to file with you when you file your Chapter 13. Married individuals have the right to file an individual case.

Even if your spouse does not file with you, his/her income will still be counted for purposes of evaluating your “ability to pay” your creditors in a Chapter 13. This is why your Clark & Washington lawyer will ask you to provide paystubs and other proof of income from your non-filing spouse. Monthly expenses unique to your spouse that do not count as “household expenses” can be backed out for purposes of household income calculations – your lawyer can show you how these calculations work.

Similarly, when you and your lawyer create a budget that will be filed with your Chapter 13 case, your non-filing spouse’s income must be revealed, but your budget can contain expense categories for monthly expenditures that are solely in your spouse’s name.

When you meet with your Clark & Washington lawyer, he or she will evaluate your financial situation and show you how Chapter 13 works if you file jointly with your spouse or if you file individually. One of the questions that we will always ask – did your spouse co-sign with you on one or more accounts. If your spouse is a co-signer, he or she can be held fully responsible for 100% payment of a debt that you may pay at only 5 or 10 cents on the dollar. In such a case a joint filing may make the most sense for everyone.

Yes, you can use Chapter 13 to stop a foreclosure on a rental property, or on any real estate that you own. The automatic stay that goes into place the second we file your case and a case number is assigned will put a halt to any pending foreclosure.

Chapter 13 cases involving rental properties do create additional challenges to you and to your Chapter 13 lawyer. The Chapter 13 trustee assigned to your case will usually take the position that the personal financial reorganization contemplated by Chapter 13 of the Bankruptcy Code is designed to help you keep all reasonable and necessary property. Rental property, by its nature, involves a degree of speculation. Many things can happen when you are in the business of renting property – your tenant may leave, you may be called upon to pay for an expensive repair, the rental market may change forcing rental rates down.

Many Chapter 13 trustees take the position that if you want to reorganize under Chapter 13 and keep your rental property, your plan needs to provide for 100% (or close to 100%) payments to your other creditors. As a Chapter 13 trustee recently explained to one of our lawyers “we are not going to ask your client’s other creditors to subsidize his real estate investments.”

As a rule, therefore, you can end up paying a higher plan payment and a larger percentage dividend to your unsecured creditors if you include a rental property and seek to keep it. That being said, Clark & Washington has filed dozens of cases for clients with rental property and we have successfully represented these clients to a confirmation.

Of course if you are considering filing Chapter 13 and you own a rental property, please make that fact known to your Clark & Washington lawyer so that all of your options can be discussed.

Although Chapter 13 is correctly known as the most common type of bankruptcy to stop a foreclosure, it is not the only type of bankruptcy proceeding that will create an automatic stay. Chapter 7 liquidation bankruptcy filings will also stop a foreclosure as will a Chapter 11 reorganization, and in some cases these other types of bankruptcy filings may be appropriate.

Chapter 7 to Stop a Foreclosure

If you have fallen behind on your mortgage payments and you want to surrender your home as well as wipe out your other debts, Chapter 7 may be a viable option. As is the case with Chapter 13, when you file a Chapter 7, the automatic stay goes into force and any pending foreclosure must stop.

Assuming that your Chapter 7 Statement of Intentions provides for a surrender of your home, the mortgage lender will need to file a Motion for Relief from Stay, wait for a hearing on the motion (3 to 6 weeks), then restart the foreclosure process (4 weeks). Thus, Chapter 7 would not only eliminate any personal liability that you might have from an unpaid mortgage, but a filing would give you time to get your affairs together and find a new place to live.

Chapter 11 to Stop a Foreclosure

Although Chapter 11 is best known as a business reorganization bankruptcy, it can be used by individuals to reorganize. In fact, Chapter 11 is the only option to reorganize if your debts exceed the debt ceilings currently in force under Chapter 13 (no more than $336,900 0f unsecured debt and/or $1,010,650 of secured debt). Chapter 11 operates similarly to Chapter 13 in that the debtor prepares and files a plan of reorganization that has to be confirmed (formally approved) by the Bankruptcy Judge.

Chapter 11 is somewhat less practical for most people because of its cost – the filing fee alone is currently $1,039. Attorneys fees for Chapter 11 are also much higher than Chapter 7 or Chapter 13 consumer bankruptcy fees.

With a Chapter 7 bankruptcy, the debtor will seek the elimination of outstanding debt. The elimination of debt in this case often calls for the debtor’s assets – minus personal belongings such as clothes and household necessities – to be gathered and sold so as to pay off the outstanding debt. A debtor’s house may even be included as an asset that the debtor must relinquish in order to pay off debt (although it is possible for Chapter 7 filers to keep their homes – create link).

Conversely, in a Chapter 13 bankruptcy, the debtor is not seeking a discharge of his/her assets to pay off debt. Rather, the debtor seeks to arrange and agree to a “repayment plan” in order to retain assets. In this case, the debtor gets to keep his/her assets – including his/her home – as long as the repayment plan is followed. A Chapter 13 may take anywhere from 3 to 5 years. Conversely, a Chapter 7 takes approximately 90 days.

Thus, the key difference between a Chapter 7 and a Chapter 13 is that in the former, the debtor’s assets (home typically included) are used to pay off debt, while in the latter, the debtor makes payments over time in order to keep his/her assets (home included). People often use Chapter 13 as a means of avoiding foreclosure (create link).

Determining Which Type to FileBankruptcy Law requires that if a debtor has the means to file Chapter 13, then they must do so. You cannot file Chapter 7 unless you can show that your income, being below a set level, will not suffice for making Chapter 13 payments. Thus, which type a debtor files is largely determined by their particular situation.

In any case, it is wise to consult with an experienced bankruptcy attorney if you are thinking about filing for Chapter 7 or Chapter 13. The attorneys here at Clark & Washington file over 500 bankruptcy cases each month and know the requirements of Chapter 7 and Chapter 13 bankruptcies.

What are the court filing fees?

Presently, the court charges a fee for filing chapter 7 of $335.00. The court's filing fee for chapter 13 is $310.00.

How do I get started?

Call our office at (813) 345-5954 to set up a FREE consultation with one of our bankruptcy specialists.

Get in Touch!

If you would like us to contact you, please provide the following information:

Foreclosures Stopped! Lawsuits Stopped!

Repossession Stopped!

We do the work for you:

-

We complete all paperwork.

-

We request your tax transcripts.

-

We attend all of your court hearings.

-

Credit Counseling done in our office.

-

Credit reports obtained same day.