Frequently Asked Questions

Chapter 13 allows the debtor to keep a valuable asset, such as an estate, and make payments to creditors over time – usually three to five years.

In chapter 7 cases, a trustee collects the assets of the debtor's estate, reduces them to cash, and makes distribution to creditors, according to the debtor's right to retain certain exempt property and the rights of secured creditors.

Because there is sometimes little or no nonexempt property in chapter 7 cases, there may not be an actual liquidation of the debtor's assets.

A discharge releases the debtor from personal liability for certain specified types of debts and prevents creditors from taking any form of collection action on the discharged debts. In most chapter 7 cases, the debtor receives a discharge just a few months after filing for bankruptcy. In chapter 13 cases, the court grants the discharge following the debtor's successful completion of all payments under the plan.

Although a debtor is relieved of personal liability for all debts that are discharged, a valid lien (i.e., a charge upon specific property to secure payment of a debt) that has not been avoided (i.e., made unenforceable) in the bankruptcy case will remain after the bankruptcy case. Therefore, a secured creditor may enforce the lien to recover the property secured by the lien.

In chapter 7 cases, the debtor does not have an absolute right to a discharge. An objection to the debtor's discharge may be filed by a creditor, by the trustee in the case, or by the United States trustee. A creditor who desires to object to the debtor's discharge must do so by filing a complaint in the bankruptcy court before a specific deadline. In chapter 13 cases, the debtor is entitled to a discharge upon completion of all payments under the plan.

May a debtor pay a discharged debt after the bankruptcy case has been concluded?

A debtor who has received a discharge may voluntarily repay any discharged debt even though it can no longer be legally enforced. Sometimes a debtor agrees to repay a debt because it is owed to a family member or because it represents an obligation to an individual for whom the debtor's reputation is important, such as a family doctor.

How do I get started?

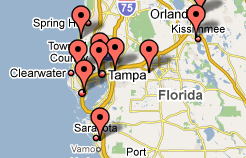

Call our office at (813) 345-5954 to set up a FREE consultation with one of our bankruptcy specialists.

Get in Touch!

If you would like us to contact you, please provide the following information:

Foreclosures Stopped! Lawsuits Stopped!

Repossession Stopped!

We do the work for you:

-

We complete all paperwork.

-

We request your tax transcripts.

-

We attend all of your court hearings.

-

Credit Counseling done in our office.

-

Credit reports obtained same day.